Travel Insurance Trends in Canada

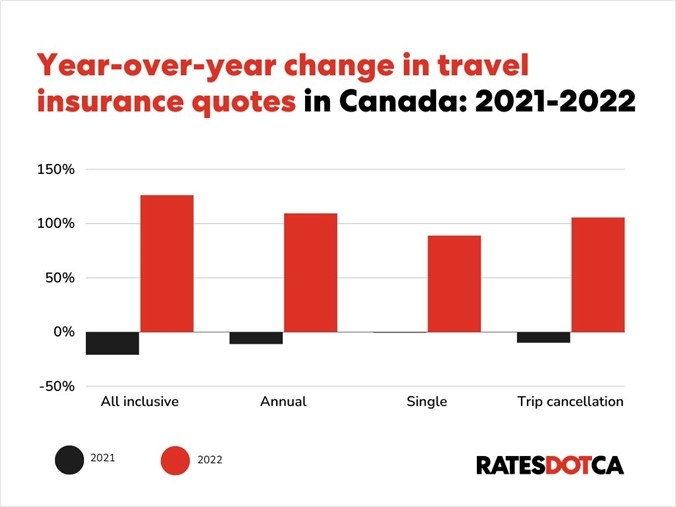

Canadians’ interest in travel insurance has surged since pandemic restrictions were lifted, with Google data and industry sources showing sharp increases in related searches and quotes. Major query categories include general travel insurance (for outbound trips), trip cancellation insurance, visitor-to-Canada/Super Visa insurance, and international student insurance. According to Google’s analysis (June 2022), searches for a “travel cancellation policy” in Canada jumped 210% year-over-year, and overall travel-insurance queries roughly doubled (+100%). Industry data corroborate this trend: RATESDOTCA reports that between 2021 and 2022, quote requests for all-inclusive travel insurance jumped ~126% and for trip-cancellation plans ~105%.

Chart: Year-over-year change in Canadian travel insurance quote requests (2021 vs 2022) by plan type. Sources: RATESDOTCA. Canadians flocked to buy insurance as travel resumed – for example, all-inclusive (comprehensive) insurance quotes more than doubled by 2022. Travel insurance demand peaked in the summer of 2021 (July–Sept) when “revenge travel” surged. By contrast, quote volumes in the same period of 2022 were lower, reflecting growing cost-sensitivity. In short, broad searches for travel insurance remain very popular, with obvious seasonal spikes in late spring/summer (summer vacations) and again in winter for “snowbird” coverage.

Travel Insurance (outbound).

Search interest for generic travel insurance has been consistently high. Google notes Canadians are booking trips again and “making sure they’re covered for unexpected changes”. Outbound travel insurance-related searches doubled from 2021 to 2022. Industry analytics show that by mid-2022 the highest insurance quote volumes had already occurred, with late summer 2021 (post-lockdown travel boom) being the peak period. Quotes for annual and single-trip plans also rose strongly; for instance, all-inclusive (family) quotes were up +1,589% in Q3 2021 vs Q3 2020, though growth moderated by late 2022. In practice, this means searches and purchases of broad travel coverage (including medical and cancellation) remain the dominant segment. In addition, “snowbird insurance” (for Canadians going to warmer climates in winter) has seen seasonal spikes; one industry report notes that as cold weather returns, demand for long-term travel insurance (“Snowbird Insurance”) surges.

Trip Cancellation Insurance.

Travel-cancellation coverage has become a hot search topic. Google’s Trends team found that queries for cancellation policies shot up 210% YoY as travelers prioritized refundable bookings. RATESDOTCA data confirm this heightened interest: quote requests for trip-cancellation plans climbed 105% from 2021 to 2022. This reflects greater caution: Canadians increasingly look up “cancel travel insurance” or “trip cancellation insurance” before booking. Seasonally, cancellation searches tend to spike in spring and early summer (when many trips are planned) and again before the winter holidays. Overall, trip-cancellation coverage ranks among the fastest-growing insurance sub-topics in search data.

Visitor-to-Canada Insurance & Super Visa.

Get Super Visa Insurance Quote Here

Interest in insurance for inbound travelers and long-stay visitors has grown in line with Canada’s tourism rebound. In 2023 Canadian tourism revenue hit $109.5 billion, surpassing pre-COVID levels. Travel-insurance providers note that demand “opens new avenues” as international and domestic travel recovers. Accordingly, queries for “visitor insurance Canada” and related terms have climbed (especially from spring 2022 onward). A special category is the Super Visa (for parents/grandparents of Canadians). Although precise search-volume data are limited, policy changes in 2025 are likely to drive interest. For example, IRCC announced in January 2025 that Super Visa applicants may purchase private health insurance from foreign companies. This regulatory change makes Super Visas more accessible and likely will prompt more searches for “Super Visa insurance”. In summary, searches related to visitor/travel medical plans (including Super Visa coverage) have trended upward with border reopening and are now a prominent niche.

International Student Insurance.

Study in Canada Medical Insurance Quote

“International student travel/health insurance” searches tend to peak with the academic calendar. Before 2024, Canada saw record growth in international student enrollment, each student needing private health coverage. However, IRCC capped new study permits in 2024, cutting intakes by ~40%. This policy shift is expected to dampen some search demand in 2024–25. Data hint that interest in student insurance peaked in summer 2023 (around fall term planning). In general, search interest in student plans remains significant but will reflect broader immigration trends: as long as international student numbers are high, “student insurance Canada” remains a common query.

Seasonal Spikes & Recent Trends:

Overall, travel insurance searches follow typical travel seasons. Summer vacation months (June–Aug) and winter holiday periods see clear spikes. For example, RATESDOTCA reported that travel-insurance quote volumes were highest in July–September 2021. Conversely, searches dipped in late-2022 as travelers pulled back due to costs. Snowbirds drive winter peaks: travel-insurance providers emphasize that coverage for February–April Caribbean or Florida trips spikes early in the year. Recent data (late 2024) show strong autumn interest as travelers plan year-end holidays despite economic concerns (Ipsos/Allianz survey notes a slight pullback in 2025 travel intent, but insurance queries remain elevated).

In summary, general travel insurance remains the most searched category in Canada, with trip cancellation and visitor/Super Visa coverage also prominent. Google’s own data indicate a 100–210% YoY increase in travel-insurance-related searches after 2021. Industry reports align with this: RATESDOTCA found triple-digit growth in quotes for all-inclusive and cancellation plans in 2022. Search interest shows clear seasonal patterns and reacts to policy changes (e.g. Super Visa rules) and travel demand shifts (e.g. student visa caps). These insights reflect the current Canadian landscape: as tourism rebounds, Canadians are proactively seeking diverse insurance products, from basic travel medical plans to specialized coverages like Super Visa and student insurance.